What should income mean in pledging? |

January 21st, 2017 |

| ea |

The pledge text uses the phrases "what I earn", and in their FAQ has for What do you mean by income?:

By income, we mean your gross salary or wages, prior to income tax being deducted. This does not include money gained through other activities, such as investment income. However, if you wish to donate a proportion of this in addition to 10% of your salary then you are of course welcome to.

This is a good starting point, but I think it's still somewhat vague. For example:

- Part of my compensation at Google is in the form of stock, which I sell immediately. Is that income?

- Part of my compensation at Wave will be in the form of stock options. Is that income? What if I do an 83(b) election?

- I received various kinds of bonuses at Google: annual, spot, peer, oncall, baby-bonding, etc. Are these income?

- When I set aside money pre-tax for my 401k or IRA, is that income? What if do a Roth 401k or IRA instead?

- Are contributions by my employer to my 401k income?

- If I set aside money pre-tax in a flexible spending account for medical care or dependent care, is that income?

- If I choose a high-deductible health plan at work that comes with a health savings account, and my employer contributes to it, is that income?

- If my employer gives me a taxable gift, is that income?

- Are tips income?

- Is money earned as a contractor income?

Being very literal about "salary or wages" I guess I would say that stock, bonus, tips, contracting fees, and employer contributions are not included, but employee contributions are? (Or maybe only employee IRA contributions?) But this is inconsistent with how I read "what I earn", especially when some industries use stock or bonuses as a major form of compensation.

The thing is, the government has already put a lot of thought into figuring out a system of what counts as income: our tax system. Lots of people are trying to pay as little income tax as possible, so the government has already had to figure out a robust system for categorizing people's economic activity. They have answers to all the questions above, and they do come out reasonably close to my sense of what "income" means.

So I'm proposing that GWWC should explicitly adopt the tax code's definition of income. In the US, for example, I think GWWC should recommend people donate 10% of their adjusted gross income (AGI). I'm not sure what the equivalent names are in other countries, but since most countries have some form of income tax I suspect it's not too hard to sort out?

(This is what Julia and I do to figure out our donation responsibility, and the income numbers we put on our donations page are AGI numbers.)

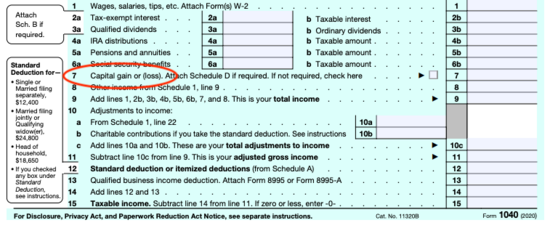

Update 2017-01-21: [EDIT: this is wrong] In the comments people pointed out that I didn't talk about capital gains. In the US, if you sell things (stocks, bonds, houses, etc) for more than you paid for them, you are taxed on this profit. It's not included in your AGI, however, and is taxed differently. While the FAQ explicitly excludes investment income, I don't see why you would exclude it, and I think in the US people should be donating a percentage of their AGI plus their net capital gains.

Update 2021-05-31: AGI already includes net realized

capital gains:

Comment via: google plus, facebook